Idemitsu Australia, a subsidiary of Idemitsu Kosan Co.,Ltd., continues to diversify its global portfolio of energy assets with a strategic investment in leading West Australia-based lithium exploration company Red Dirt Metals (ASX: RDT), in its recent capital raising round.

The investment in Red Dirt Metals is in line with Idemitsu’s global strategy to diversify the portfolio and invest in high-growth markets such as lithium, which is a key component in the production of electric vehicles and energy storage systems.

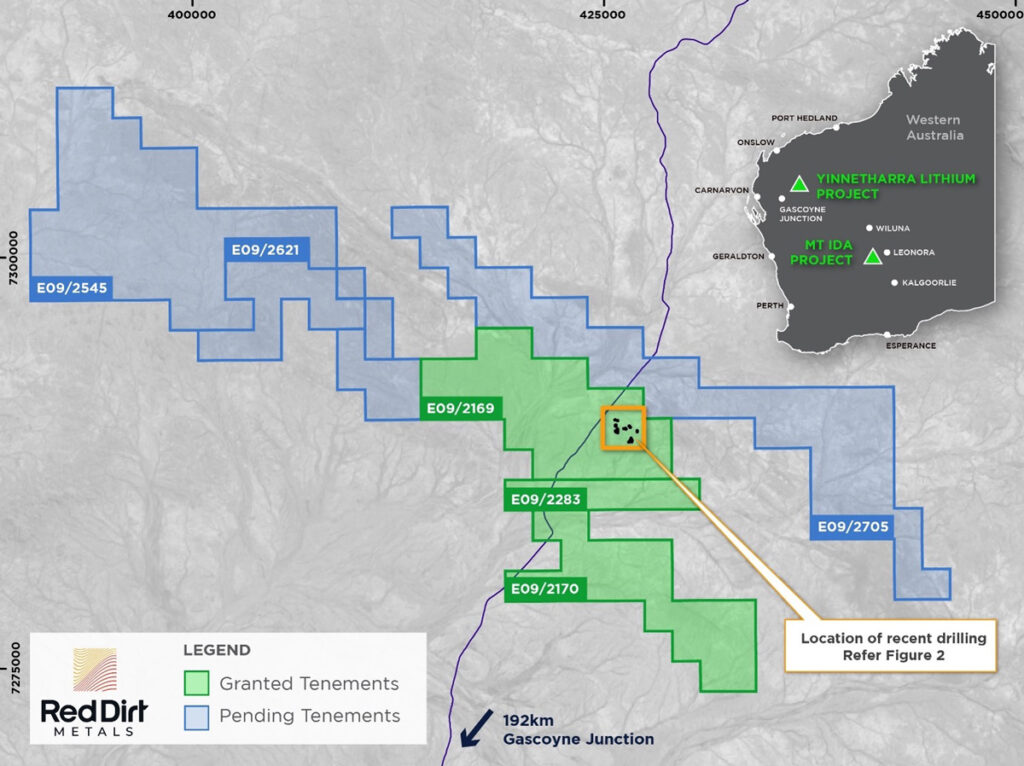

Idemitsu’s initial investment of $5 million, which is 10 million shares, will give Idemitsu Australia approximately 2.3% of issued shares in Red Dirt Metals. The proceeds from the capital raise round will be used by Red Dirt Metals to progress drilling, mining studies, test work, feasibility studies, environmental approvals and working capital for both the Mount Ida and Yinnetharra lithium projects.

Steve Kovac, CEO of Idemitsu Australia, said the company would continue to diversify its portfolio for a sustainable energy future. “Our strategic relationship with Red Dirt Metals will provide exposure to advanced mining technology and expertise in lithium mining as the Mount Ida and Yinnetharra projects move through their respective development phases to full operations,” Mr Kovac said.

“We will continue to look for opportunities to invest in critical minerals as the global demand for sustainable energy sources grows.”

The strategic lithium investment follows Idemitsu’s recent significant investments in Vecco Group, a private company developing the Debella Critical Minerals Project and in Critical Minerals Group (ASX: CMG), a vanadium focused company planning to develop the Lindfield Project, both located near Julia Creek in Queensland’s north-west minerals province.

With these investments Idemitsu is building a value chain for local production and local consumption that includes the mining of vanadium, the refining of vanadium pentoxide and the production of vanadium electrolyte, thereby contributing to the stabilisation of the supply of vanadium and the creation of demand in Australia.

Mr Kovac said “the company’s major investments in both the Vecco Group and Critical Minerals Group supports the global renewable energy and electrification transition. Both companies are planning to establish vanadium mines near Julia Creek, with the Debella project also producing high purity alumina. The Vecco Group is also developing the first commercial-scale vanadium electrolyte manufacturing plant in Queensland, which will produce electrolyte for vanadium redox flow batteries.”

“Idemitsu continues its global strategy to diversify its portfolio of energy assets and transition to a carbon neutral society, while supporting the next generation of mobility with the development of new materials to make the energy transition possible.”

“With these important strategic investments, we are demonstrating our commitment to innovation and partnering with emerging companies to build a brighter energy future. As global demand for critical minerals grows, we will continue to seek opportunities where we can be a strategic, long-term investor in other critical minerals ventures in Australia,” he said.

Idemitsu Australia has been operating in the country for more than 40 years, as a subsidiary of Japanese company Idemitsu Kosan Co.,Ltd. and is proactively diversifying its Australian energy portfolio through mining, retail fuels, agriculture and renewable initiatives.

With a focus on innovation, Idemitsu Australia continues to explore solar, hydro, wind and battery hybrid alternatives across Queensland and New South Wales, and is deeply committed to the safety and wellbeing of its people and working with local communities to create sustainable outcomes.